Inokom was incorporated in October 1992 through a joint venture between companies from Malaysia France and South Korea. More 66.

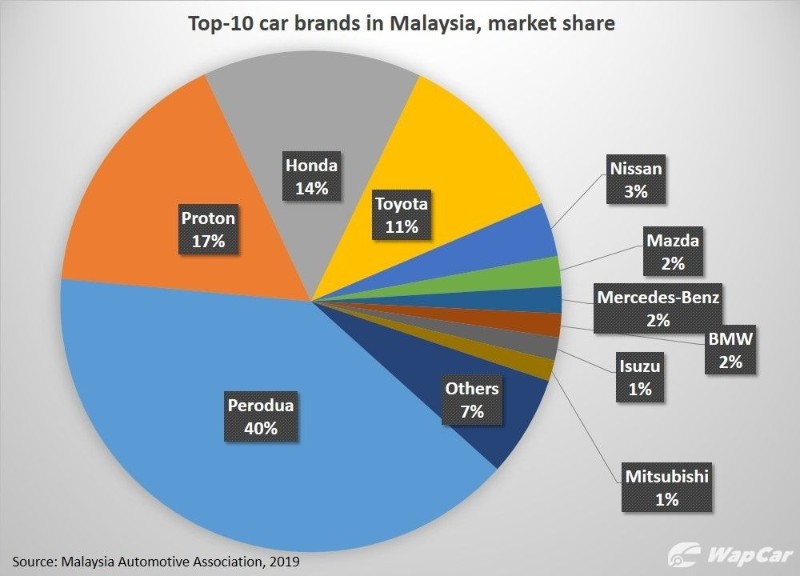

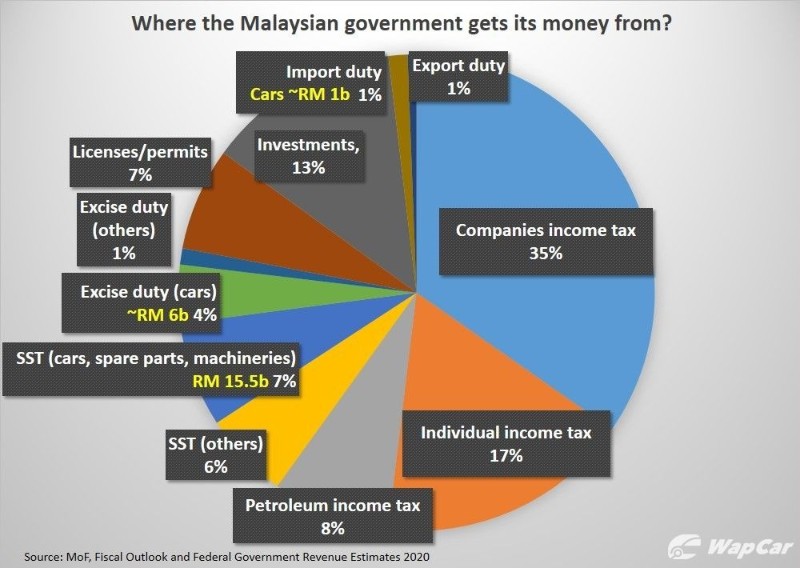

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

As of 2019 the import duty for CKD-vehicles.

. Anti-dumping duty is an import duty charged in addition to normal Customs Duty and applies across the UK and the whole EU. Malaysias location has long made it an important cultural economic historical social and trade link between the islands of Southeast Asia and the mainland. After getting the current duty rates its time to calculate the import duty and total import tax which mainly consists of the following parts.

Import Duty and Sales Tax Exemption on KN95 Type Face Mask. Brightway Holdings Sdn Bhd Laglove M Sdn Bhd and Biopro M Sdn Bhd. BCD depends upon the HSN code of the product and the Country of Import.

Although they may also be imposed on a particular basis import tariffs are often assessed on an ad valorem basis. K2 - Export for dutiable and non-dutiable goods. How much is the import duty in Malaysia.

The amount of import duty you will be required to pay for your cargo as a consequence. 6 Jalan TP3 UEP Subang Jaya Industrial Park 47620 Subang Jaya Selangor Malaysia. K3 - Import Export of dutiable and non-dutiable goods within Malaysia.

Basic Customs Duty BCD. In 1998 Inokoms shareholders included the Berjaya Group. The country has to rely on imports to meet the gap between demand and supply.

Sales value of manufactured parts and accessories for vehicles in Malaysia 2019-2021. Import of edible oil is under Open General License. This is the tax that is calculated on the Assessment Value of the goods that have landed at the customs border of India.

Ordinary magistrates courts already had this power but the. Currently an overseas company with no permanent establishment in Malaysia would not be liable to register for Sales Tax or Service Tax. This duty calculator is using the 2019 Current Retail Selling Price CRSP in line with the KRA directive issued in Aug 2020.

News on Japan Business News Opinion Sports Entertainment and More. 14062018 the import duty. K1 - Import for dutiable and non-dutiable goods.

A company undertaking manufacturing and selected services activities may apply for MIDA Confirmation Letter Surat Pengesahan MIDA SPM for the purpose of claiming import duty andor sales tax exemption from Royal Malaysian Customs Department on machineryequipmentspare partsprime moverscontainer trailers subject to the fullfilment of. It can vary between 0 to 100. The situation in Malaysia and Brunei differs in that local courts do have caning powers over juveniles and in Malaysia these were actually increased in 1999 with new Childrens Courts being given the power to order up to 10 strokes with a light cane for boys aged between 10 and 18.

Before the implementation of PMK 1992019 a 10 income tax applies to taxable goods in addition to the value-added tax and import duty. More 97 21112019 Guide on Sales Tax Deduction Facility. However from 1 January 2020 foreign service providers of digital services to consumers in Malaysia exceeding MYR500000 per year will be liable to register for Service Tax.

Tariffs and other taxes on import and export. YTY Industry Holdings Sdn Bhd YTY Group including YTY Industry Sdn Bhd Green Prospect Sdn Bhd and GP Lumut. Inokom is the licensed contract assembler for Hyundai BMW and Mazda passenger vehicles in Malaysia.

Therefore thanks to these new regulations importers now only have to pay 175 for taxable items for import into Indonesia 95 fewer than the previous 27. 3 September 2019. Originating in Malaysia Anti-Dumping Duty 2321.

Customs value customs duty rate imported quantity customs duty rate. 02122019 Guides on Customs Ruling. We have tailored the KRA 2019 CRSP to focus on the prestige cars most suited to our clients.

In order to harmonize the interests of farmers processors and consumers and at the same time regulate large import of edible oils to the extent possible import duty structure on edible oils is reviewed from time to time. More 98. K8 - Declaration of duty not paid goods a By rail - Pasir Gudang declared K8 to rail the containers from Pasir Gudang to Port Klang without paying the duty.

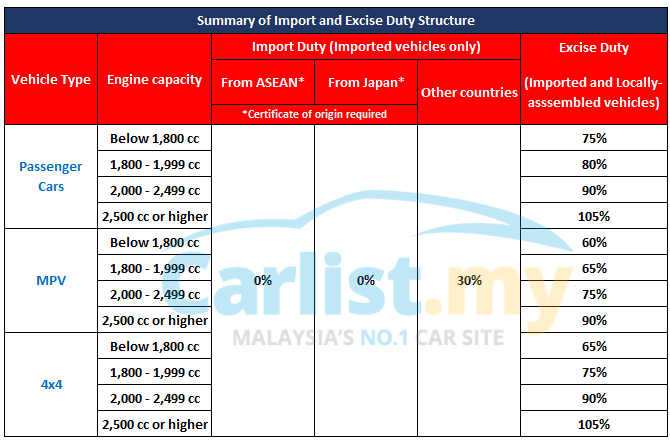

For ASEAN members the import duties do not apply anymore. Commercial value 03464 not less than 272 and more than 52833 HMF Fee. Ad valorem import duty rates might be anything from 2 and 60.

Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods including animals transports personal effects and hazardous items into and out of a country. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2. Is a subsidiary of Malaysian-based Sime Darby Motors.

Traditionally customs has been considered as the fiscal subject that charges customs duties ie. Commercial value 0125. Our prestige car duty calculator calculates the car import duty for prestige cars when imported to Kenya.

Resigned on 6 January 2019. The position of the king is primarily ceremonial but he is the final arbiter on the appointment of the prime minister head of government.

Malaysia Market Profile Hktdc Research

How To Calculate Uk Import Duty And Taxes Simplyduty

Tire Imports Spike Despite Elevated Duties Tire Business

![]()

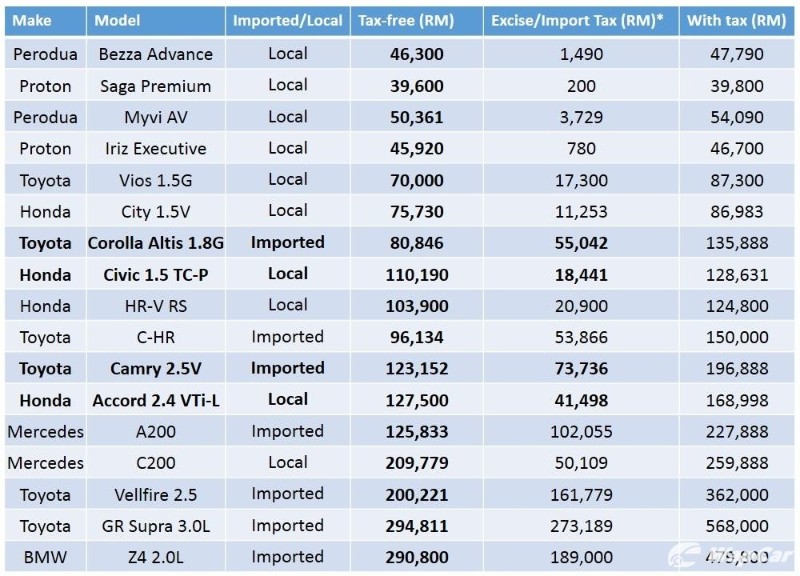

Here S What 2019 Imported Cars Cost Before Taxes In Malaysia

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Shipping To Malaysia Services Costs And Customs

Shipping From Malaysia To The Uk Updated September 2022 Freightos

Import Duty Malaysia Buy Discounts 51 Off Evanstoncinci Org

What Does Brexit Mean For Malaysia And Palm Oil Mpoc

Economist Calls To Lift Import And Excise Duties On Cbu Cars In Malaysia Wapcar

Looking To Purchase Vehicles Parts Online From Overseas Stores Watch Out For Import Duties Taxes Paultan Org

Government Mulls Lower Excise Duty For Cars How Low Will Prices Go How Realistic Is It Insights Carlist My

Looking To Purchase Vehicles Parts Online From Overseas Stores Watch Out For Import Duties Taxes Paultan Org

Customs Duty Tax Receipts Uk 2022 Statista

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Here S What 2019 Imported Cars Cost Before Taxes In Malaysia